2022-04-22 I have lived a life of "if you don't play the game, you won't lose" which has enabled me to read books, write columns, do programming, and eat rice. [長年日記]

A reader of the column recommended the book, "Fooled by Randomness" -- which is interesting.

I think the introduction's sentence, "Why do people think it's their own ability when they make a profit on an investment and think it's bad luck when they lose money?" in the introduction.

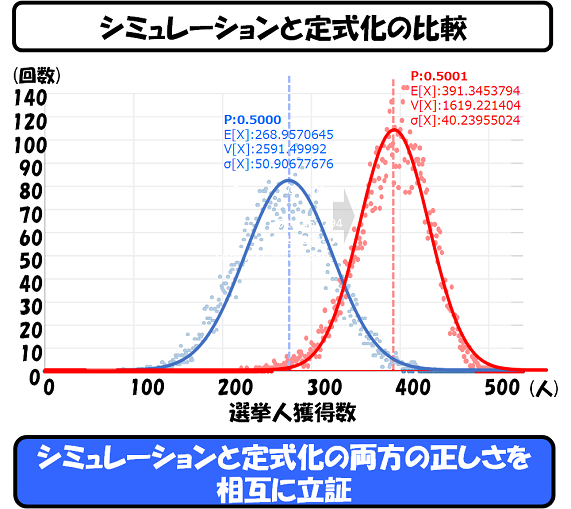

I have "used" or rather "abused" the "Monte Carlo method" frequently mentioned in this book.

It is really easy to get a quick probability value answer with a simple program rather than a complicated formula.

I used to use the Monte Carlo method all the time in my columns around here, and it was really useful.

(A reader has since successfully formulated it.)

Aside from that.

-----

As a mathematical analysis engineer, it is common sense to me to say, 'If you start playing the game, you lose at that point.

It seems to me that I have done too many calculations in the past to believe that I am the only one who can win.

I have lived a life of "if you don't play the game, you won't lose" which has enabled me to read books, write columns, do programming, and eat rice.

I think this is quite a 'win' -- although not very noticeable.

-----

Oh, I would like to take this opportunity to report on the progress.

"Random Walkers on Wall Street" Barton Malkiel -> Unread

"Learn to Earn" Peter Lynch, -> unread

Fast & Slow" Daniel Kahneman → read

"Fooled by Randomness" Nicholas Taleb -> read

"Black Swan" Nicholas Taleb → read

"Moneyball" Michael Lewis → read

"Flash Boys" Michael Lewis →read

-----

In particular, "Flash Boys" is a highly praised book by Ebata that I can't tell you how many times I've read it.

# I was dazzled by how bad the story of the film adaptation was (really, that was a waste of time).

Anyway, after reading "Flash Boys," I understood on a soul level that "ordinary people trading are just going to get eaten alive.

In my current series, "The Engineer who is not loved by money", I have only 'index investing' as an option.

Well, I'll get back to this story at some point.